Matchless Tips About How To Become A Credit Provider

Select one of three pathways:

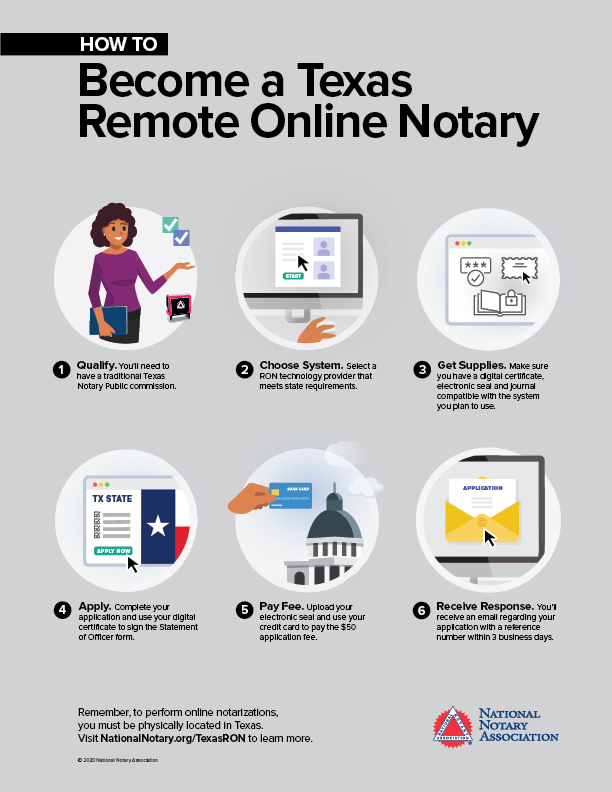

How to become a credit provider. Application fee to the national credit regulator. You must register your company or be a sole proprietor. If you would like to use the carecredit program but your healthcare provider does not offer it, please take a moment to fill out the referral information below.

Obtaining a credit provider takes only a few steps. We'll explain the program and processing fees. How to become a payment service provider.

You have to have excellent financial systems in place, including the carecredit credit card. Subscription options that work for you. Complete the ncr application form.

1 step 1 enroll to accept carecredit fill out a quick form, talk to a member of our team about your exact needs, and we'll get you signed up. Being identified as a shrm recertification provider eliminates the. To begin and support your process, please review the educational.

To become a credit card processing agent, there are two. The main thing that can be tricky is succeeding to the point that you have a nice stream of recurring, residual income. To apply for aafp cme credit, cme providers must follow the below steps to submit an online credit application.

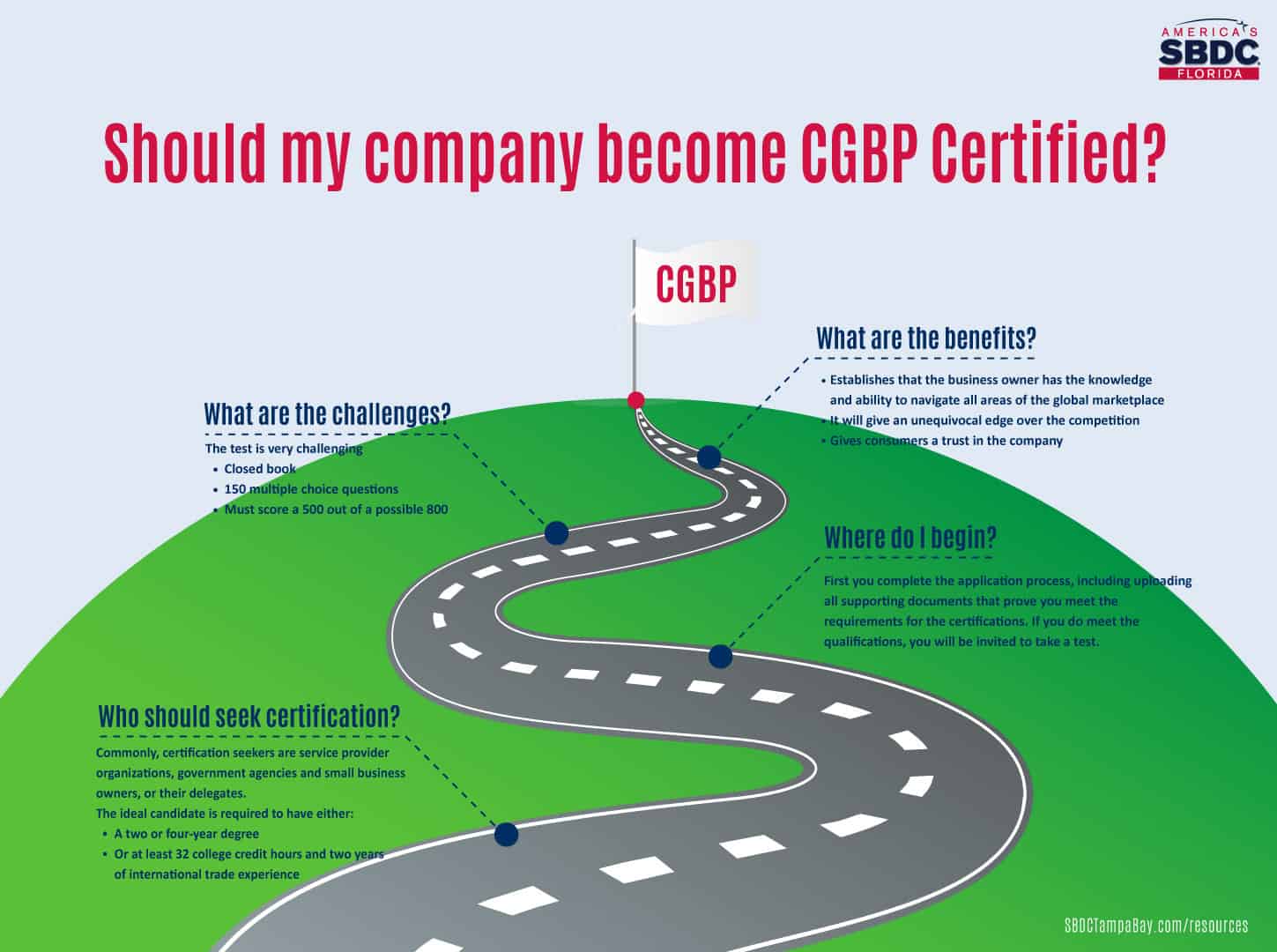

Application form for registration as a credit provider in terms of section 40 of the national credit act 34 of 2005. There are many options in becoming a registered aia continuing education provider—in person or online, from local to global and at multiple price. Credit providers must pay an initial application fee and thereafter, an annual registration renewal fee which is based on the amount of principal debt due to that provider.

To get started with your application please go to shrmcertification.org/providers/apply to complete and submit the online application to join the program. Obtain the share certificate/s if. Digital credit providers, or, dcps have become some of the most active financial service providers in kenya as they channel their services primarily through the ubiquity of.

One of the best aspects of running your business as a payment processor is that when you are a payment processing company, you have more control over the entire process. As part of the application.