Favorite Tips About How To Find Out If Your Taxes Will Be Garnished

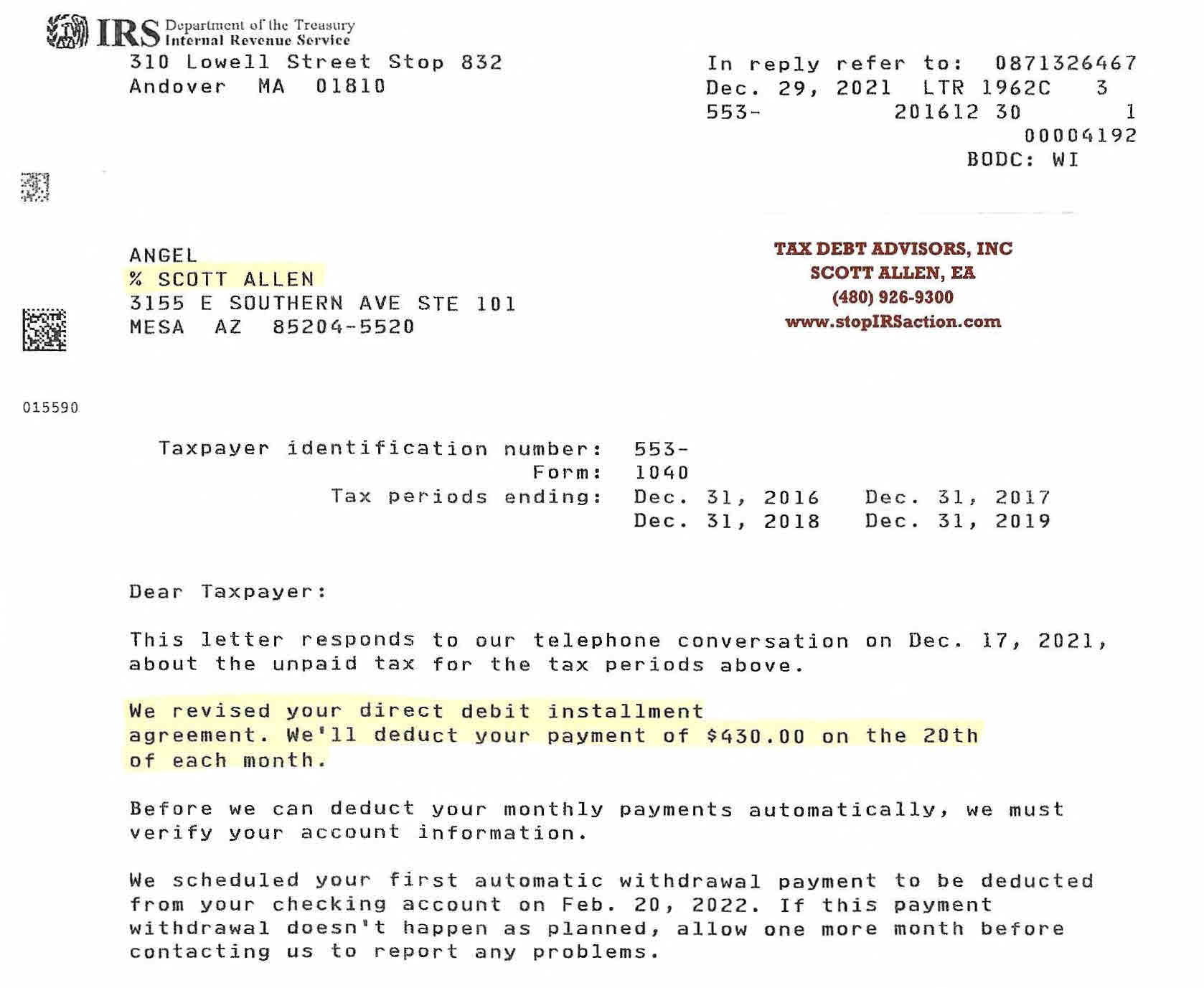

We base payment amounts on your pay periods and your employee’s required deductions.

How to find out if your taxes will be garnished. Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: You can look for ‘other’ or even ‘miscellaneous’ on your paycheck and this will help you to really work out if any wage garnishment has occurred. How to find out if my tax return will be garnished?

Using the irs where’s my refund tool viewing your irs account. It is also important to review. Moreover, only certain types of.

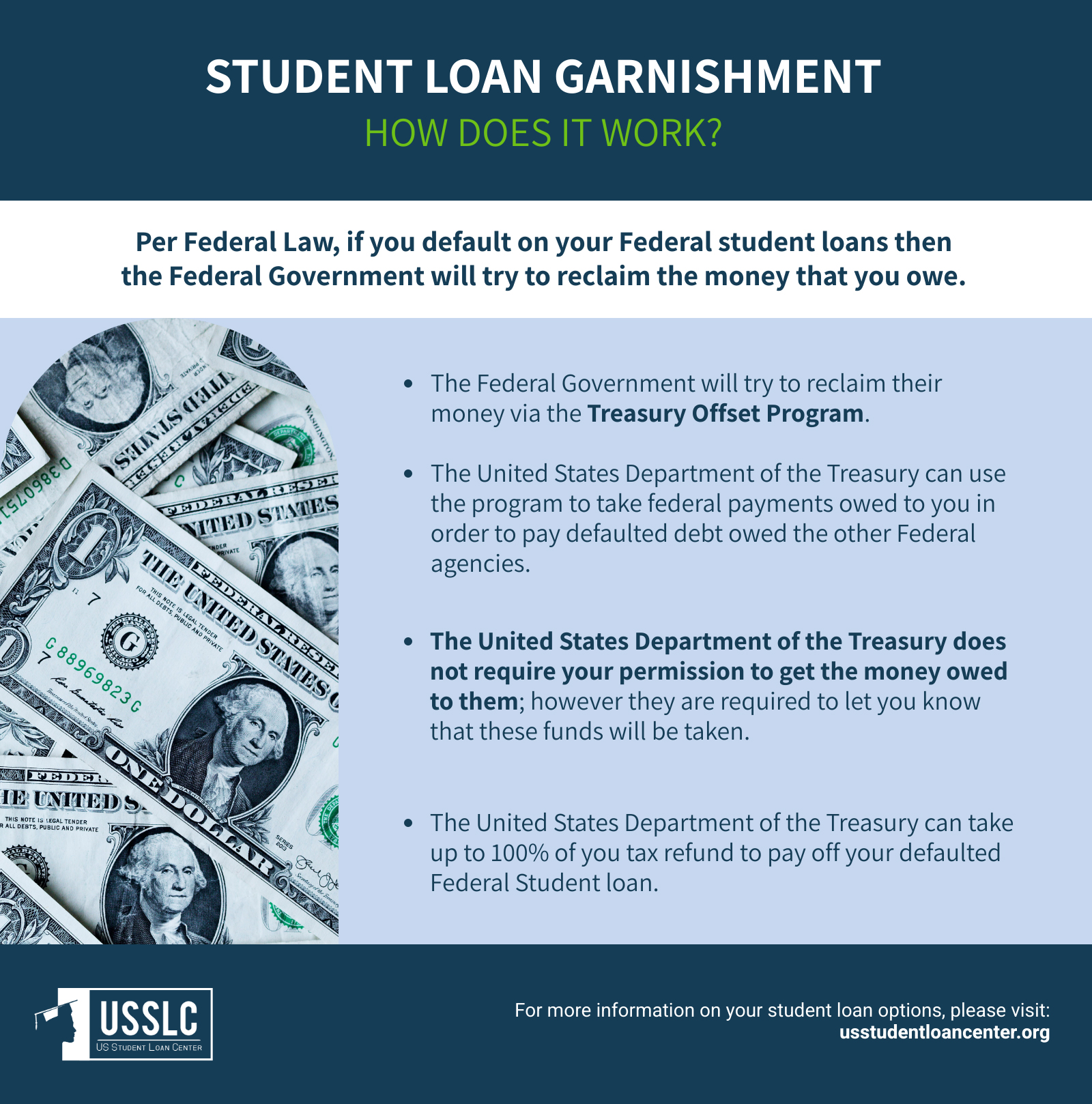

If you have more than one ticket, the search results will not display the payment status, so you'll have to. Private creditors such as credit card companies don’t have access to your tax refund. Federal income tax refund garnishment occurs when the irs believes you owe extra money to the government, and they cannot collect the debt.

The top is the only way your refund can be garnished; If your creditor is eligible to garnish your tax. Search by driver's license number or name and date of birth to review your tickets.

Over or under garnishing your employee’s pay can cause complications to their ftb account. Ask if it has received a garnishment notice for you. It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle.

How can i find out if my tax return will be garnished process. You can call this number, go through the. How do i know if my refund will be garnished?

Track your balances and spending in one place to see your way out of debt. Step 2 talk to the payroll department of the company you work for if you suspect your wages are being garnished.