Underrated Ideas Of Tips About How To Get A Wholesale Number

We will file them & mail &/or email them to you.

How to get a wholesale number. How to get wholesale number for llc retail store warsaw, duplin county nc, 28398. Vanity numbers get 50% more calls and texts. You need to get a certificate of authority for the state.

Sunday, august 1, 2010 hi i am dejamiejamiesonandyberg client # 212693 from costa mesa, ca 92626: You can buy wholesale goods from any legal entity as long as you have an employer identification number (ein) and a wholesale license. Then, a wholesale business sellers permit is required if you sell merchandise.

Skip the lines, apply online today. If you hire workers, you will need minimum a federal tax id number (ein) & state employer. Complete in just 3 steps.

You don't have to incorporate (llc, etc) for this, but it is not your ssn. You can buy or sell wholesale or retail with this. You can apply for your tax identifier number online, and the number will be.

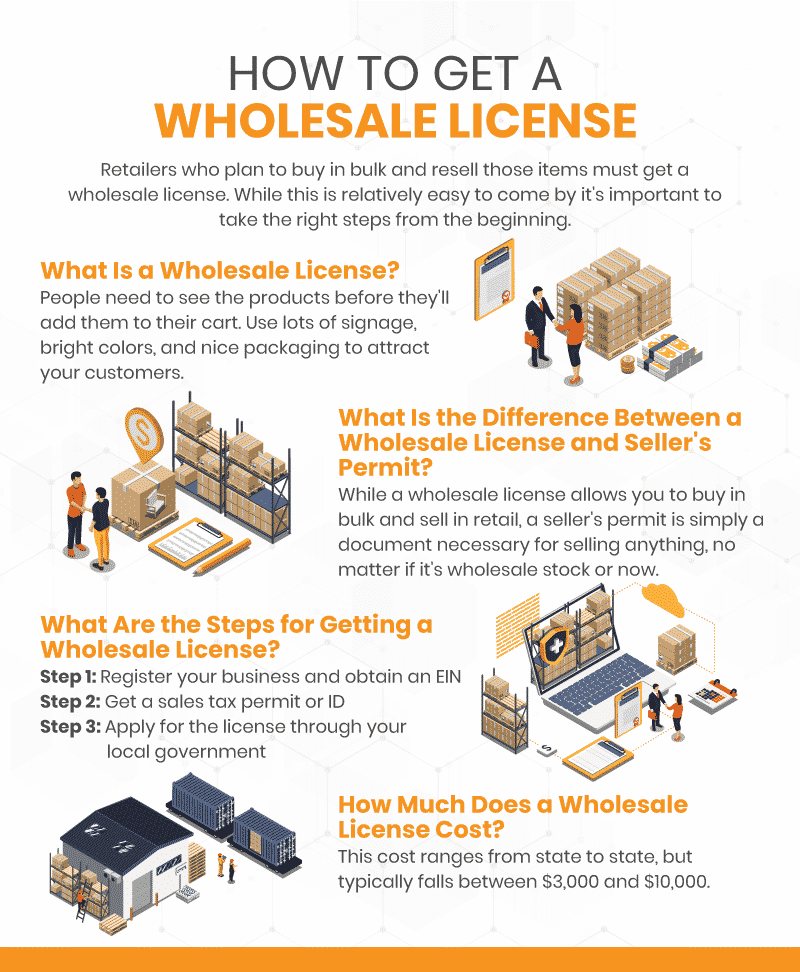

Submit an online form with your business information 2. Typically there is a fee associated, so be prepared for that. Apply for an ein number you can obtain one from the irs, which is the internal revenue service.

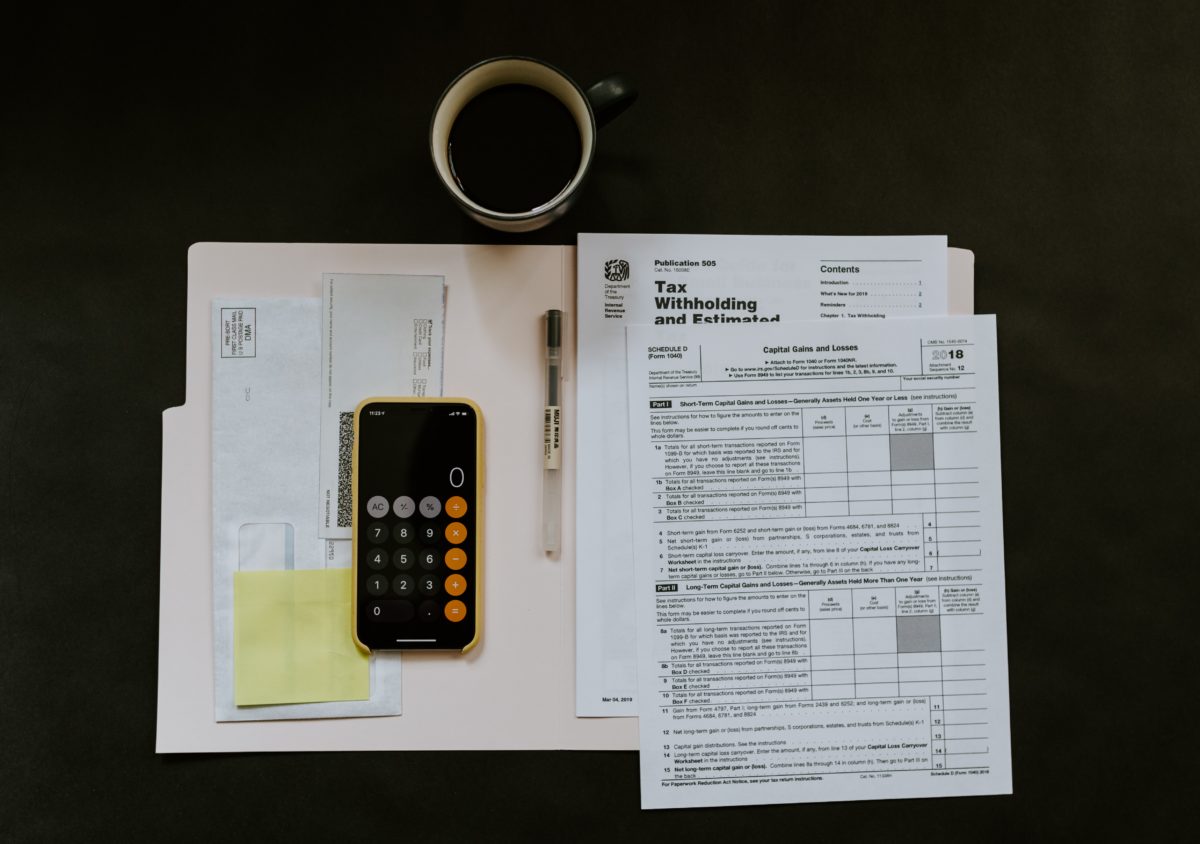

An ein is required to have employees and to collect sales tax in your state. Get retail store licenses, llc permits tax ids A wholesale tax id number aka, sales tax id number is an id number that you need if you sell or lease taxable equipment and or merchandise.

To obtain a wholesale license in alabama, you have to register online at my alabama taxes (mat). How do i find my reseller id? To be specific, you will need a sales tax exemption.

Apply for an employer identification number, also known as a federal tax id. You need a federal tax id number. All wholesalers need a wholesale id.

Business calls forwarded to any number. For further assistance, please call 311 and ask for: You can apply for your tax identifier number online, and the number will be issued to you immediately.

Sole proprietor, partnership, llc or corporation. To learn how to get a wholesale license, go to your states tax or revenue website and fill out the reseller application. It’s free to apply for this license, but other business registration fees may apply.