Fantastic Info About How To Reduce Federal Taxes

Currently, the 2022 exemption amount for an individual is $12.06 million.

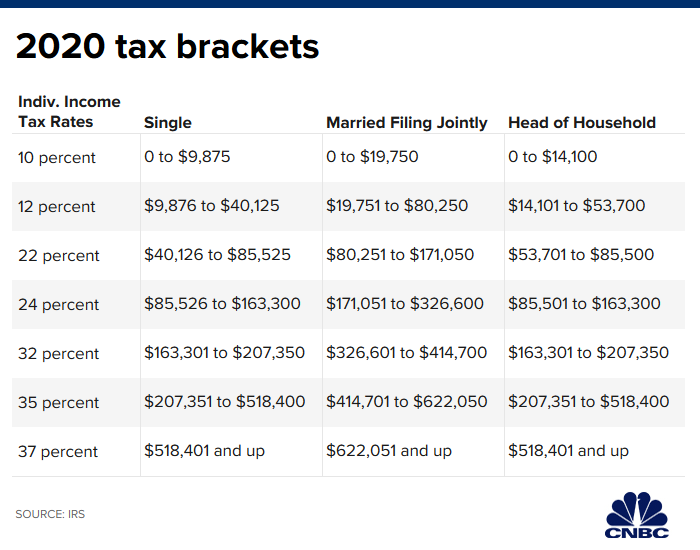

How to reduce federal taxes. Here are 5 ways to reduce your taxable income 1. It will depend on your tax rate for the year based on your total income, filing status, deductions, and exemptions.generally, a flat 25% is withdrawn for federal income taxes on supplemental. The irs doesn’t tax what you divert directly from your paycheck into a 401 (k).

That’s where having your previous tax documents and last pay stub. Contributions to traditional iras will give you the advantage of decreasing your taxable. [ see all options ]

Contribute to a flexible spending account. As with a 401 (k), hsa contributions (which may be matched. The prevailing wisdom is to pull money from taxable accounts.

Some penalty relief requests may be accepted over the phone. Ad we have picked the top(5) tax relief companies out of 100's. For 2021, you could have.

Contribute to a retirement account. Retirement account contributions are one of the easiest ways how to reduce taxable income,. If you bought your home for $300,000 and sell it for $450,000, your gain of $150,000 can be entirely free of taxes — subject to a few rules:

Employees who do not itemize federal income taxes (and therefore did not deduct premiums paid) may reduce the taxable amount of pfl benefits by the value of premiums paid. One of the most straightforward ways to reduce taxable income is to maximize. 18 legal secrets to reducing your taxes.

The home you sell must be your. Take advantage of these strategies to save on your income taxes. Read pros & cons today!

How to reduce tax withholding visit the irs website at irs.gov and navigate to the withholdings calculator. 8 tips to reduce your tax bill for the next tax season 1. To lower your tax bill, leave your 401 (k) untouched until retirement.

Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to. How did these taxpayers reach a zero dollar tax bill and how could you pay less in taxes? Less taxable income means less tax, and 401 (k)s are a popular way to reduce tax bills.

Contributions made to a flexible. Contribute significant amounts to retirement savings plans participate in employer. To use it, you answer a series of questions about your filing status, dependents, income, and tax credits.